Return to flip book view

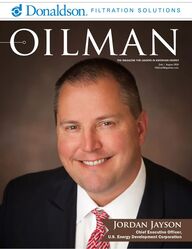

THE MAGAZINE FOR LEADERS IN AMERICAN ENERGYJuly / August 2024OilmanMagazine.comJordan Jayson Chief Executive Officer, U.S. Energy Development Corporation

opito.comOPITO Open LearningFlexible courses designed to enhance your energy career. The OPITO Open Learning portfolio, accredited by City & Guilds, allows learners to tailor their learning around their personal and work commitments while gaining an industry-recognised certication. Oil & Gas Electrical Engineering Systems Subsea Technology Series Petroleum Processing Technology SeriesOil and Gas Well Technology Series Introduction to the Oil and Gas IndustryHelicopter PublicationsExplore more here opito.comOPITO Open LearningFlexible courses designed to enhance your energy career. The OPITO Open Learning portfolio, accredited by City & Guilds, allows learners to tailor their learning around their personal and work commitments while gaining an industry-recognised certication. Oil & Gas Electrical Engineering Systems Subsea Technology Series Petroleum Processing Technology SeriesOil and Gas Well Technology Series Introduction to the Oil and Gas IndustryHelicopter PublicationsExplore more here

Letter from the Editor PAGE 2OILMAN Contributors PAGE 2OILMAN Online PAGE 3Industry Data PAGE 3CARBON EMISSIONS Collaboration is the Catalyst for Signicant Trust, Efciency and Value Creation PAGE 4OPINION Listening to Industry Underpins OPITO’s Commitment to Safe Helideck Operations Globally PAGE 8INVESTING EM Holdings Corporation Touts SE Energy Fund II for Uptick in Energy Sector Investments PAGE 10Oilman Puzzle PAGE 14CARBON CAPTURE & SEQUESTRATION Key Investment For A Bridge To A Cleaner Environment PAGE 20Oilman Cartoon PAGE 24SURVEY Riding the Wave: Consumers Embrace Oil and Gas Environmental Impact, Stress Over Costs, and Grapple with Details PAGE 26PERSONAL TRANSITION From Gold Medal Engineer To Digital Solutions Developer PAGE 30WIND ENERGY New York’s South Fork Wind Project Marks Major Milestone PAGE 32DECOMMISSIONING El Dorado, Arkansas PAGE 34IN THIS ISSUEConstruction site visit at U.S. Energy’s future home in The Armour Building, located in the Fort Worth Stockyards Historic District.Oilman Magazine / July-August 2024 / OilmanMagazine.com1FEATURE U.S. Energy Development Corporation CEO Jordan Jayson Maintains an Independent Dynamic with Smart Spending and a Joint Venture Blueprint PAGE 16

Oilman Magazine / July-August 2024 / OilmanMagazine.com2JULY — AUGUST 2024PUBLISHER Emmanuel SullivanEDITOR-IN-CHIEF Rebecca PontonMANAGING EDITOR Nick Vaccaro COPY EDITOR Shannon WestCREATIVE DIRECTOR Kim FischerADVERTISING SALES Diana George Connie LaughlinSUBSCRIBE To subscribe to Oilman Magazine, please visit our website, www.oilmanmagazine.com/subscribe. MAILING ADDRESS U.S. Energy Media P.O. Box 3786 Galveston, TX 77552 Phone: (800) 562-2340 e-mail: editor@usenergymedia.comCOPYRIGHT The contents of this publication are copyright 2024 by U.S. Energy Media, LLC, with all rights restricted. Any reproduction or use of content without written consent of U.S. Energy Media, LLC is strictly prohibited.All information in this publication is gathered from sources considered to be reliable, but the accuracy of the information cannot be guaranteed. Oilman Magazine reserves the right to edit all contributed articles. Editorial content does not necessarily reect the opinions of the publisher. Any advice given in editorial content or advertisements should be considered information only. Cover photo courtesy of U.S. Energy Development Corporation.LETTER FROM THE EDITORBREAKING NEWS … BREAKING NEWS … BREAKING NEWS … David C. Lawler Named CEO of Kimmeridge Texas Gas, LLCIt was announced on June 25th that longtime energy executive David Lawler had accepted the position of Chief Executive Ofcer of natural gas producer Kimmeridge Texas Gas, LLC. This follows his previous role as Chairman and President of bp America.As Lawler shared with Oilman Magazine in May of this year, “Natural gas is going to become very important to the world well beyond heating and cooling, the uses that most people are familiar with ... There’s so much more to the natural gas story. The natural gas reserves in the U.S. are so signicant that being able to use the resources we have, combined with carbon capture, can make a very big difference in lowering emissions across the world, helping countries and entire populations reach net zero.” In an exclusive comment to Oilman Magazine, Lawler says, “I’m pleased to join the Kimmeridge team. Our production growth trajectory and wellhead to water strategy will help power economies around the world with low emissions natural gas produced here in the United States.” To read more about Lawler’s 30-plus year career in the energy industry, see the May cover feature of Oilman Magazine.Nick Vaccaro, Managing EditorI nd myself reecting on and even evaluating the political events of our country. The third day of the Republican National Convention (RNC) is wrapping up. Former President Trump recently survived an assassination attempt, and President Biden’s cognitive capacity is being scrutinized while the Democratic party scrambles to conduct damage control. With each occurrence, political gureheads and the mainstream media have made desperate cries for unication, understanding of one’s neighbor, and a call to relinquish the hatred that has overshadowed the 2024 presidential election. Some from all political vantage points have attempted, but we have yet to succeed.That same call to reduce the rhetoric and to unify can be applied to the energy industry. I address the audience as “the energy industry” because it is more signicant than just oil and gas. As the world’s appetite for fuel and power generation continues to grow, all forms of energy production play a pivotal role. While recognizing this fact, let me be clear. Oil and gas are critical to everyday life and are here to stay, but not as an exclusive energy production solution. As the world evolves, multiple solutions are needed. Instead of the constant and heated battle waged at oil and gas, I think it is evident that steps should be made to reduce the hatred leveled against fossil fuels and concentrate that energy into understanding and respect with strides made in listening to what your neighbor has to offer. In this case, the oil and gas sector and the alternative energy movement should stop the sparring and listen to what each has to say.I am a regular in the oil and gas world and am proud of the career I have been fortunate enough to build. As I travel the highway from Kenedy, Texas, and through a small town called Pawnee, I nd myself smiling, seeing the wind turbines turning. Their presence does not threaten me nor do I feel they are a direct attack on oil and gas. Instead, I view them as an ally in providing power to the population. Each opposing force in the energy industry should step back, take a realistic approach to understanding the other’s viewpoints, and then exercise the ability to nd common ground and unify in administering solutions. Oil and gas are here to stay, electric vehicles have a place in different scenarios, solar panels prove helpful and, if the wind is blowing, energy can be gained. Each has a place, and the energy spent trying to destroy each other would be better directed to unify and offer the world energy options gained through safe and responsible generation.

Oilman Magazine / July-August 2024 / OilmanMagazine.com3DIGITAL INDUSTRY DATAConnect with OILMAN anytime at OILMANMAGAZINE.com and on social media#OilmanNEWSStay updated between issues with weekly reports delivered online at OilmanMagazine.comSOCIAL STREAMAverage annual West Texas Intermediate (WTI) crude oil price from 1976 to 2024 (in U.S. dollars per barrel)Number of drilled but uncompleted oil and gas wells in the United States from April 2022 to April 2024, by regionNumber of United States oil and gas rigs in operation at the end of each month from May 2022 to May 2024

Oilman Magazine / July-August 2024 / OilmanMagazine.com4CARBON EMISSIONS Collaboration is the Catalyst for Significant Trust, Efficiency and Value CreationBy Rebecca HofmannNew industry-led solutions are reden-ing operational efciency and creating growth using automation, robust stan-dards, and cutting-edge technologies.Change is upon us. The industry must adapt to ensure it keeps pace with ever-evolving requirements and governmental regulations while at-tempting to balance the narrative in the court of public opinion. Embrac-ing new technologies allows us to drive a successful path forward, manifesting our own course to meet stringent new regulations, and exceed expectations in combating carbon emissions.When it comes to carbon emissions, de-termining a path forward is complicated. As many readers will conrm, the chal-lenges facing the industry should not be underestimated. While these challenges are indeed monumental, we are almost out of time, but not out of options. Securing the Future of our Energy Supply and Our IndustryAddressing these challenges requires a multifaceted, forward-thinking approach. Embracing technological advancements and utilizing them to industry advantage can help push the status quo threshold, the effects of which are yet to be fully realized and cannot be understated. In the global energy landscape, several interconnected factors stand out as pivotal inuencers of industry dynamics and policy making. Among these, arti-cial intelligence (AI), blockchain and the Internet of Things (IoT) are emerging as a nexus of critical considerations.AI: Optimizing Energy Production and Distribution Harnessing articial intelligence (AI) as a tool in a standardized and measured way can lead to massive gains within the industry, particularly within the fold of optimizing energy production and distribution. AI-driven predictive analytics can fore-cast energy demand patterns, enabling schedule adjustments and optimization of resource allocation.Machine learning algorithms can analyse vast datasets from IoT sensors to im-prove efciency in industrial processes. AI-powered energy management systems dynamically adjust operations based on real-time conditions, minimizing wastage and reducing costs.Photo courtesy of Adobe Stock.

Oilman Magazine / July-August 2024 / OilmanMagazine.com5CARBON EMISSIONS Blockchain: Disrupting Energy Markets and TransactionsBlockchain technology offers decen-tralized, transparent and tamper-proof ledgers for recording transactions. Smart contracts, powered by blockchain, automate these transactions, ensur-ing secure and transparent agreements between parties. This innovation fosters the growth of renewable energy sources by incentivizing investment and partici-pation in distributed energy systems. In addition, trust and transparency with environmental claims and transactions are enhanced, which increases stake-holder support.IoT: Reshaping Energy Infrastructure and EfciencyIoT revolutionizes energy systems by interconnecting devices, sensors and infrastructure to collect and analyse vast amounts of data in real-time. As an example, sensor equipped trucks can provide continual tracking of deliveries to enhance real-time operating expenses and can reduce manual reconcilia-tions by up to 94 percent. This creates accurate processes that enable faster payments, empower greater decision-making, and signicantly reduce service-to-payment times.Aligning Innovation with Regulatory GuidelinesBalancing innovation with regulatory oversight is essential to harnessing the full potential of emerging technologies, while safeguarding against unintended consequences. In essence, the industry is best placed to advise how the industry works.Collaborative efforts between govern-ments, industry stakeholders, standards boards and technology innovators are crucial to addressing these challenges and driving responsible energy trans-formations. The intersection of IoT, blockchain, AI and U.S. policy stands as a focal point in addressing the world’s most pressing energy issues. By lever-aging technology advancements and informed policy decisions, we can navi-gate toward a more sustainable, efcient and resilient energy future.U.S. Policy: Strengths, Weaknesses and OpportunitiesU.S. policy decisions exert signicant inuence on global energy markets and their developments in new technology. Regulatory frameworks, tax incen-tives, and government-funded research programs play a crucial role in shaping energy priorities.The U.S. Energy Department’s initia-tives support research and development in renewable energy, grid moderniza-tion, and advanced energy technolo-gies. Policies aimed at promoting clean energy adoption, reducing carbon emis-sions, and enhancing energy security have far-reaching implications for global energy transitions.Immense opportunities for advancing energy sustainability, energy security and accessibility are at the forefront as U.S. policies evolve alongside the growth and use of advancing technologies. To align with expectations, the industry faces some challenges including data privacy concerns, cybersecurity risks and, of course, regulatory complexities.New Standards Call for a New Way ForwardPolicies are shaping new standards that the energy industry must meet in a transparent and irrefutable way. For example, in March, the U.S. Securi-ties and Exchange Commission ap-proved new requirements that public companies disclose their greenhouse-gas emissions. These new SEC rules man-date detailed climate-related disclosures in a company’s SEC lings, such as an-nual reports and registration statements. According to a statement from the SEC, these updated rules “reect the Commission’s efforts to respond to investors’ demand for more consistent, comparable and reliable information about the nancial effects of climate-related risks on a registrant’s operations, and how it manages those risks, while balancing concerns about mitigating the associated costs of the rules.”After a global review of efforts to ad-dress climate change during the 2023 United Nations Climate Change Con-ference (COP28), world leaders deter-mined actions must be accelerated. This includes a call on governments to speed up the transition away from fossil fuels to renewables, such as wind and solar power, in their next round of climate commitments.Top Investors in Energy Technology 2016 – 2020 Continued on next page...

6Oilman Magazine / July-August 2024 / OilmanMagazine.com6CARBON EMISSIONS 406-590-3200 | mark.workman@rmisupply.comwww.rmisupply.comBlending ProgramsAnionic Friction ReducerPHPA, Xanthan, Defoamer Drilling Detergent and More!Capacity: Up to 8 loads per dayPackaging: Pails, Totes, or BulkNSF Certied Facility and ProductsSERVING OILFIELD, MINING, AND WATER TREATMENTRMI SUPPLYThese examples show that the in-dustry is at a pivotal moment and harnessing digital technology ensures not just survival, but the opportu-nity to thrive. To meet these new requirements, it is our opinion that the industry must empower digital technologies to provide deep insights. These investments in our future will help drive informed decision-making for emissions reduction strategies and efcient operations.The wholly veriable data provided by solutions such as AI, blockchain and IoT can help businesses meet the requirements for accurate, transparent and veriable information today.Embracing the Future of the Industry (and Reaping the Benets) As an industry, we are already adapting – developing and deploying compre-hensive solutions that leverage these new systems.As an example, Blockchain for Energy (a non-prot consortium of energy industry experts) has recently released B4E Carbon. It’s an emissions man-agement solution, developed for the energy industry by the energy industry and powered using technology de-veloped by Enovate AI. The solution provides an intelligent and ultra-secure digital framework for data-driven validation processes of environmental claims. It is available on a secure indus-try-approved platform and is used by a growing list of industry heavyweights. B4E Carbon simplies and automates mandatory EPA reporting. It is a vital tool for transparency and collabora-tion, data management, real-time monitoring, validation and verication – and claims reversal prevention. With an “operations-rst mindset,” B4E Carbon emphasizes the integration of emissions management into core busi-ness operations, ensuring that emis-sions reduction becomes a priority at every stage of the value chain, driving continuous improvement in sustain-ability performance.When platforms like this are devel-oped with industry standards and col-laboration in mind, the result is greater transparency among stakeholders. This transparency can help build trust and facilitate cooperation, all of which are vital for addressing emissions manage-ment effectively.Results That Speak for ThemselvesThe industry has an urgent need for accurate, transparent and veriable emissions data. The integration of these new technologies provides an intelligent and ultra-secure digital framework, for data-driven validation processes of environmental claims, all while aligning with regulatory bodies and capital markets requirements.The convergence of AI, blockchain and IoT represents a paradigm shift in the way industries operate. As the in-dustry embraces these transformative technologies, it is essential to address concerns around data privacy, security and ethical implications. Collaborative efforts between industry stakeholders, policymakers and technologists are crucial to ensuring that the benets are harnessed responsibly and sustainably.New technologies, such as the B4E-Carbon solution, now offer unprec-edented opportunities for digitaliza-tion, optimization and monetization. They also offer a route through decarbonization while conforming to industry standards and helping busi-nesses thrive. Rebecca Hofmann is an accomplished nance and compli-ance leader with over 20 years of experience in the energy industry. Her past op-erational assignments have covered the development and improvement of processes over governance and compliance to support onshore and offshore operations. She is the founder and visionary behind the Blockchain for Energy consortium, where she is the standing CEO and served as chairman of the board two years prior. Hofmann’s many industry awards and accolades include the 2018 GRIT Award for Creativity and Innovation, the 2019 GRIT Award for her team’s work in emerging technologies, and the 2021 Global Supply Chain Leaders Blockchain CEO of the Year Award. She has also authored several thought leadership articles related to blockchain technology. How it works: The rst Comprehensive Emissions Management System B4E Carbon

406-590-3200 | mark.workman@rmisupply.comwww.rmisupply.comBlending ProgramsAnionic Friction ReducerPHPA, Xanthan, Defoamer Drilling Detergent and More!Capacity: Up to 8 loads per dayPackaging: Pails, Totes, or BulkNSF Certied Facility and ProductsSERVING OILFIELD, MINING, AND WATER TREATMENTRMI SUPPLY

Oilman Magazine / July-August 2024 / OilmanMagazine.com8OPINIONListening to Industry Underpins OPITO’s Commitment to Safe Helideck Operations GloballyBy Lucie BoothAs OPITO, the global safety and skills organization for the energy industry, launches regionally specic helideck standards for the Americas, Product Development Manager Lucie Booth explains how it will enhance safety in this critical offshore operation.The entire offshore industry, and its workforce, is reliant on daily safe trans-fers to offshore installations in an open sea environment.In April of this year, HeliOffshore re-leased its annual report, which covers the period from 2013 to 2023, provid-ing a global perspective on the safety performance of the offshore aviation industry over the last decade. While progress has been made, the results of the data show there’s more work to be done to ensure safe operational activity in the challenging offshore environment.In the Gulf of Mexico (GOM), fac-tors such as rising deep-water offshore development activity, the growth of the offshore wind industry, and the im-proved viability of offshore oil and gas projects mean the number of journeys to and from offshore helidecks in the region is only set to increase.As a not-for-prot business, OPITO works in partnership with industry stakeholders to identify the need for Photo courtesy of Shutterstock.

Oilman Magazine / July-August 2024 / OilmanMagazine.com9OPINIONnew and improved global training and competence standards for the world-wide offshore workforce.With a lack of standardized helideck team member training in the Gulf of Mexico, it became clear that the U.S. offshore industry was missing the op-portunity to optimize safe operations on the helideck. Together with Maersk Training, and other industry partners, we have worked to develop robust training standards to meet the specic requirements of the region.The Helideck Operations Initial Train-ing (Americas) and Helideck Operations Emergency Response and Aviation Fuel Management Awareness standards were designed and updated to reect legisla-tion and operational differences in the Gulf of Mexico and are now being rolled out after a successful pilot. The standards offer a minimum bench-mark for training in relation to Helicop-ter Landing Ofcer (HLO) competence across the Americas to ensure the safe operation of helidecks, and the safety of those working in this area, as well as workers traveling offshore in helicopters. Although CAP 437 and HSAC-RP are widely adopted as guidance within the region, these bespoke standards build on the regional specic requirements for HLOs and those undertaking emer-gency response and refueling duties.They will ensure a consistent level of training required to meet recommended practices for safety across the entire Americas region. They will also mean greater exibility for the workforce to move between projects. From initial conversations, we perceive the uptake will be very positive and are already looking to grow the number of training centers which can provide the courses to broaden the standards’ reach.As in everything we do at OPITO, col-laboration has been key in delivering these bespoke standards for the Ameri-cas. The energy industry is inherently complex, but if we can work together to standardize training while remain-ing exible, this will have a powerful and effective impact on offshore safety worldwide.More about OPITOOPITO is the global skills organization for the energy industry. There are over 500,000 OPITO registrations every year, across 50 countries through 230 accred-ited training centers.OPITO works to develop a safe and skilled workforce by driving global standards and qualications, creating workforce development solutions and leading dialogue with industries and governments. With operation centers in four regions – the U.K. and Europe, Middle East and Africa, Asia Pacic and the Americas – OPITO is driving safety and competency improvements to benet the industry and providing career pathways and training opportuni-ties for the current workforce and the next generation.For more information, please visit OPITO.Lucie Booth is the Product Development Manager at OPITO with over 11 years’ experience working in the energy industry. Booth joined OPITO in March 2014 and has held a number of product assurance and development roles, and was appointed to her cur-rent role in April 2023.Booth has a passion for ensuring every individual can reach their own learning potential. Key achievements to date have been the development and review of multiple products, in particular the growth of OPITO’s qualication portfolio, achieving and maintaining OPITO’s SCQF accreditation, and the governance of OPITO’s awarding body activity.Booth is an active member in a number of external forums includ-ing OEUK’s aviation and hydrogen groups. Lucie Booth, OPITO Product Development Manager with Training Helicopter.

Oilman Magazine / July-August 2024 / OilmanMagazine.com10INVESTINGEM Holdings Corporation Touts SE Energy Fund II for Uptick in Energy Sector InvestmentsBy Nick VaccaroThe energy sector receives glorifying re-views for its efforts in alternative energy but, according to a recent New York Times’ article, fossil fuels continue to remain strong when contemplating how to meet the globe’s increasing energy demands. Despite expecting to see stied growth through governmental regulation and a predicted decrease in overall spending on growth, oil and gas companies have been displaying signicant activity throughout the year. Considering current trends and the future of what is to come in American politics, Erick Moore of EM Holdings Corpora-tions says we are sitting on the cusp of an explosion of activity that yields incredible investment opportunities for businesses and private individuals.As managing principal of EM Holdings, Moore brings a robust history of oil and gas experience to assess the market, analyze data, and make specic direction predictions. This practice guides the rm during the investment process, where it performs a complete due diligence process on all its prospective investments. Its group of equity investors includes in-vestment groups, pension funds, endow-ments, bank afliates, and high-net-worth individuals known as angel investors. When analyzing an investment opportu-nity, Moore and EM Holdings address infrastructure, ensuring it is in place but stable and experienced. Business models must be clearly dened with a focus on one primary business sector. Revenue must reside in the $10 to $100 million range and earnings before interest, taxes, depreciation and amortization (EBITDA) somewhere between $3 and $10 million.Meeting these standards, SE Oil and Gas Producers, LTD, has recently been added to EM Holdings’ portfolio of invest-ment opportunities. The company offers essential services in demand and will con-tinue to see demand grow in the areas of products and services, trucking, logistics management, proppants, drilling services, oil eld services and geological services. According to Moore, energy demand is a growing and that insatiable appetite that must be fed. As a result, the time for in-vesting in fossil fuels is now, regardless of the overall public opinion that defames oil and gas daily.“I think primarily right now we’re in an election year,” says Moore. “With poten-tial change with how our government is handling things, the demand for energy is strong but will get stronger daily.”Moore points to potential opportuni-ties associated with all forms of energy. While subsidies and tax incentives have stimulated attention to alternative energy investment, fossil fuel opportunities will not just die off into the night.“There are a lot of regulatory variables that increase subsidization, but it will be a while before all things could be alterna-tive energy,” says Moore. “Even if car companies made good on their pledges to produce only electric vehicles by 2035, it will take decades to transition away from fossil fuels. The world will still require a signicant amount of oil and gas for the foreseeable future.”Factors of InuenceAccording to Moore, the energy demand is high and continues to soar mainly because the current administration has depleted federal reserves. To stie rising prices at the pump, the Biden admin-istration introduced products from the federal reserves into the market for the sole purpose of cutting off those price increases. This practice has been a com-Southeastern Oil & Gas Producers. Photos courtesy of EM Holdings Corporation.

Oilman Magazine / July-August 2024 / OilmanMagazine.com11INVESTINGmon directive by the federal government, and just recently, it restricted gas leasing on thirteen million acres of a federal petroleum reserve in Alaska.In addition to cutting leasing opportuni-ties in the offshore oil and gas sector, these restrictions have only intensied the need to increase supply to meet demand. Moore points this out as an indicator that investment opportunities will ourish in bringing ideas and solutions to fruition to meet energy demands.Moore identies current movements as precursors to explosive activity that he and his rm expect in the North American shale. Not only has drilling activity increased, while multiple -nancial institutions predict-ed 2024 spending to remain at, interest is also growing with exploration activities moments from being initiated.“The rig count alone is up 65 per-cent,” Moore points out.The Eagle Ford Shale extends across 26 counties in central and south Texas and has a rich oil and gas history with its rst well being drilled in 2008. The forma-tion did not see an uptick in drilling until 2010, but when the boom struck the in-dustry, it beneted from a signicant run until 2015. The area began to recover in 2019 and has consid-erable production, with drilling rigs still seen in numerous counties.While the Eagle Ford boomed with activ-ity and remains productive, Moore says the new potential is fueling investment opportunities in oil and gas. The Buda Limestone formation spans the High Plains and Trans-Pecos regions of West Texas and continues eastward, nding itself overlaid by the Eagle Ford Shale. Moore points to additional infrastructure and support services needed in the Eagle Ford area to help bring the Buda online.“This next layer should be even more protable than the Eagles Ford,” Moore predicts.With LNG activity remaining a staple in the energy supply quest, Moore maintains that West Texas and Haynesville activity will continue to grow, fueling investment opportunities throughout.Moore targets what many have thought to have played out in southern Louisiana as an opportunity. According to data studied and science applied, the Interstate 10 corridor through Calcasieu Parish promises to see a resurgence in oil and gas activity. Its proximity to Lake Charles and Cameron, Louisiana, certainly inu-ences probability.“We foresee signicant activity and op-portunity in that area of Louisiana in two to three years,” says Moore.Moore and his rm have directed at-tention to Oklahoma due to additional discoveries in what is already a bustling area. While many companies seek growth through increasing and enhancing exist-ing production, the boom of investment opportunities will rely on drilling. The wells must be drilled for the other sup-EM CAPITAL MANAGEMENTUSING DIVERSE VENTURE IDEOLOGIES "FOR GENERATIONAL WEALTH BUILDING SUCCESS"Investment BankersEMHC INVESTMENT CORP | www.emhcinvest.comContinued on next page...Eric Moore, Managing Partner, EM Holdings Corporation.

Oilman Magazine / July-August 2024 / OilmanMagazine.com12INVESTINGport services to enter the picture and, for that to occur, Moore warns that a change must be made.“I think the White House is realizing now that they have to make a change,” says Moore. “To thrive, they are going to have to loosen and pave the way for domestic drilling programs.”Identifying Key Investment OpportunitiesSupport services for drilling campaigns will offer many investment opportunities, but Moore foresees additional outlets. Great opportunities will populate the areas of water supply and condensate disposal. With all sectors of oil and gas requiring water, it will be in high demand for drilling and hydraulic fracturing needs. That water must be sourced from somewhere; opportunity will surface with trucking, supply and treatment.A critical component of oil and gas operations is that what-ever is sent downhole must return to the surface. Injecting water downhole returns to the surface as condensate, which will need to be properly removed from the location and sites.That support structure provides endless opportunities. Saltwa-ter disposal facilities will need to be constructed to service the growing supply, additional trucking will need to be in place, and related services will increase.Moore feels the drilling uid market will foster further invest-ment opportunities in the oil and gas industry. If activity increases, the supply of drilling uids must grow proportion-ately. A signicant increase in uid supply could create an environment for the formation of new companies to assist in meeting that new demand.Startup companies focusing on these various areas can of-fer further opportunities. Moore says that new companies entering the industry can capitalize on an upward market and, if established early enough, can see signicant increases in protability as demand increases. Getting in early allows inves-tors to capitalize on big prots down the road with minimal investments made in the present.Introducing the SE Energy Fund IIMoore and his rm currently have $227 million under management for alternative energy investments. New opportunities are available through the SE Energy Fund II, which encompasses several components of the fund’s makeup. It includes active drilling opportunities in south Louisiana, and additional drilling opportunities also span the Texas Gulf Coast. SE Energy Fund II includes interest in saltwater disposal facilities, hydraulic fracking, along with active drilling oppor-tunities in Oklahoma, Louisiana, Wyoming and West Texas. The fund continues to honor its robust design, concentrating on the acquisition of active and protable energy services companies both domestically and overseas.Moore’s SE Energy Fund II reigns as an investment solution rooted in entertaining those multiple areas of investment interest. Having analyzed the data and potential, Moore feels the SE Energy Fund II offers a diverse opportunity in invest-ment returns, catering to multiple areas of oil and gas that are expected to grow in proportion to the response in meeting en-ergy demands. Given the current opposition to the oil and gas industry, yet the anticipated increase in activity through a new presidency, Moore and his rm reason oil and gas will remain a necessity and, therefore, a staple in investment portfolios.Moore believes, “Whatever may be true of the death of fossil fuels in America, and in the world for that matter, our short-term, immediate future as a society is linked to the continual availability of oil and gas.”Nick Vaccaro is a freelance writer and pho-tographer. In addition to providing technical writing services, he is an HSE consultant in the oil and gas industry with eight years of experi-ence. Vaccaro also contributes to SHALE Oil and Gas Business Magazine, Louisiana Sports-man Magazine, and follows and photographs American Kennel Club eld and herding trials. He has a BA in photojournalism from Loyola University and resides in the New Orleans area. Vaccaro can be reached at 985-966-0957 or navaccaro@outlook.com. Southeastern Oil & Gas Producers Drilling Rig.

Oilman Magazine / July-August 2024 / OilmanMagazine.com14OILMAN PUZZLEACROSS 1 American ____ Institute 6 ____ temperature extraction unit 8 Watch closely 9 Natural gas that has been cooled to a liquid state for storage and shipping, abbr. 11 Slow way of speaking often associated with Texas 13 Ballpark g., abbr. 15 That ____ the question 16 Large spreading tree 17 Manchester’s state, abbr. 18 Tube used to deliver hydraulic oil to engines 19 “Much ____ About Nothing” 20 Inert gas symbol 21 State where LOOP is based, abbr. 22 Up to, briey 23 Lion constellation 25 ____ gas: natural gas containing liquid hydrocarbons in solution 26 Agent, abbr. 28 Quality ____ 30 Patriotic women’s org., abbr. 31 Tech executive, abbr. 32 Firm head, abbr. 34 “Lord ____ the Rings” 36 Placed above 37 Chemically inert, as a gas 40 ____ eld 41 DeliverDOWN 1 Blow out ____ 2 Hydro ____ 3 Scrubber ____ 4 Energies of one dyne 5 It’s used to lubricate the drill bit 6 Oil and Gas ____DOWN (continued) 7 Early oil prospector 10 ____ oil: amount of oil produced by a lease exclusive of its BS&W content 12 Flow upwards 14 Denite article 17 See 27 down 20 Energy capital 21 ____ Mans race 24 ____ Capture 25 Offshore ____ 27 PV technology, goes with 17 across 29 ____ tool drill 31 Final step in abandoning an oil well 33 Many, many years 35 Face of ange, abbr. 38 Exist 39 Driver’s ____Answers on page 22

HOSTED BY4,945ATTENDEES53COUNTRIES323EXHIBITING COMPANIESBRINGING EDUCATION AND INDUSTRY TOGETHER.SHORT COURSES: AUGUST 19, 2024SYMPOSIA: AUGUST 20 – 22, 2024GEORGE R. BROWN CONVENTION CENTER • HOUSTON, TXThe Turbomachinery & Pump Symposia is recognized worldwide as the industry’s must-attend event. Connect with more than 4,900 delegates, meet with leading suppliers, observe product demos, and get answers to your technical questions. We look forward to seeing you in Houston!TPS.TAMU.EDU#TPS2024

FEATUREOilman Magazine / July-August 2024 / OilmanMagazine.com16David Arrington from Permian Deep Rock and Jordan Jayson from U.S. Energy on-site at Airpark in Midland.

FEATUREOilman Magazine / July-August 2024 / OilmanMagazine.com17They say the backbone of the United States continues to be the birth and suc-cess of small businesses. When analyzing it from the oil and gas vantage point, U.S. Energy Development Corporation would be one of those inspirational success stories of small businesses forming in the most unlikely of places and then growing into a pillar of stability and longevity.CEO Jordan Jayson returned from a career on Wall Street to lead U.S. Energy, started by his parents, to the next level as a competitive and stable independent production company utilizing intelligent business practices and a robust strategy to navigate the turbulent waters of today’s oil and gas industry. While stories of fortune permeate history and originate in popular plays like the Lonestar state and North Dakota’s Bakken, U.S. Energy hails from Buffalo, New York.“In western New York and the southern tier of the state, there is a rich history specically of shallow gas and deep wells, but there is a moratorium on chas-ing deep gas,” says Jayson. “The rst natural gas well in the United States was actually discovered just over an hour from Buffalo.”After some rebranding in 1980 and Jayson later joining the family business, the early 2000s dictated a new vision. The company began primarily by focusing on operating vertical wells in Appalachia and expanding joint ventures to other parts of the country. Soon, Jayson and the company would expand their footprint to Texas, Oklahoma and New Mexico. Texas proved to be such a hotbed of activity that U.S. Energy relocated its corporate headquarters to Arlington. Now, it has set its sights on moving to Fort Worth within the next six months.Targeting Areas of OpportunityDriven by opportunity, Jayson points to interest in the Permian Basin, Eagle Ford, Powder River Basin, and the Haynesville plays. The company concentrates more on each new business prospect instead of focusing solely on the location, which allows for smart spending.“As a rm, we are somewhat basin agnos-tic,” says Jayson. “We have a large non-op presence in the Bakken and have par-ticipated in DJ projects and shallow well projects in Kansas. We look at ourselves as opportunity-driven by returns and try-ing to do the best we can to deploy our capital and our partners’ capital.”This strategy resonates as it supports the new oil and gas industry’s responsible and strategic spending theme. Over the past four to ve years, new projects have accounted for approximately 85 percent of U.S. Energy’s capex in the Permian’s Delaware Basin.“We have made some PDP production-type acquisitions over recent years in the Permian, but we are looking to drill wells as an operator or participate in drilling projects as a non-operator in those areas. The majority of our dollars go toward drilling new wells primarily at this point in the Permian.”Addressing Flat Spending PredictionsAs the oil and gas industry ramped up for 2024, many nancial institutions analyz-ing the industry predicted an uptick in capex spending for the international and offshore markets. Still, North American shale would stagger through the year with a at spending plague. Jayson indicates those predictions were accurate. With spending not showing signs of increase, he reasons consolidation will continue to play out for the remainder of the year.“I think that it is pretty evident that the market likes when the E&P companies are drilling within cash ows and making distributions through dividends back to shareholders,” says Jayson. “The industry through consolidation provides opportu-nities for smaller companies through joint ventures.”Through careful venture evaluation and spending allocation, Jayson has steered U.S. Energy away from consolidation and to opportunity instead. With its stable nancial portfolio, the company can embrace growth and spending ease by partnering with other companies, like those who see consolidation as the only means of survival. “We evaluate upward of 400 to 500 deals per year and traditionally buy somewhere Continued on next page...U.S. Energy Development Corporation CEO Jordan Jayson Maintains an Independent Dynamic with Smart Spending and a Joint Venture BlueprintBy Nick Vaccaro

FEATUREOilman Magazine / July-August 2024 / OilmanMagazine.com18between ve to ten percent,” says Jayson. “We are constantly looking at new op-portunities. That activity has not slowed down each year.”But, if capex spending is at, Jayson said it is not at a material level. He denes the current market situation as a good pricing environment with the service industry in a premier spot.“Right now, companies are laser-focused on making good decisions, paying divi-dends, and being thoughtful in how they are spending their money,” says Jayson.Regardless of the industry’s overall spend-ing habits and the predictions wagered toward them, Jayson remains loyal to U.S. Energy’s spending blueprint. Because of the company’s size and commitment to operating within its means, Jayson says its spending must refrain from surpassing cash ow. As a result, the rm continues to be prudent in allocating funds.“Our behavior and how we allocate dol-lars has changed drastically, and we look at the risk management side and talk about potential downturns,” says Jayson. “While it is a lot more fun to talk about growth, we have to talk about preparing for downturns and be thoughtful that if there is a correction in the market or production does go lower because of a group of wells that underperform, [then] we need to identify the adjustments we can make internally so we can continually improve our nancial position.”Identifying FundingSpending strategies inuence growth and new opportunities. In addition to capital limitations, focal areas inuence where funds are allocated. While some compa-nies might decide to follow technological advancement and seek to develop new ways to increase production, others might adhere to the traditional methods of drill-ing more wells. Current acquisitions in-clude vast PDP components, production potential, and a high volume of locations to be drilled.“I think it is a combination of gas [that] is lower than what we would like it to be, and oil has found a range while compa-nies are looking at inventory to decide if it is a good time to buy drilling and production,” says Jayson. “From U.S. Energy’s standpoint of being a smaller company, we do the same thing but at a smaller scale. We are looking for good PDP-producing assets to negotiate and transact on and layer on additional loca-tions.”According to Jayson, funding parameters Joe and Judy Jayson, Jordan’s parents and founders of U.S. Energy.Jayson family beach vacation (from left to right, top to bottom): Jagger, Jillian, Jordan, Jameson, Judson and Joie.U.S. Energy’s Solar Eclipse Party.Jordan Jayson speaking at the U.S. Energy Town Hall in February 2024.

FEATUREOilman Magazine / July-August 2024 / OilmanMagazine.com19are a sizable principal factor in determin-ing where to allocate these funds for growth. Traditional lending at the cor-porate banking level remains a challenge. Therefore, creative solutions must be wagered to secure funding.“All E&Ps’ ability to lever companies up with traditional corporate banking is still impaired,” says Jayson. “They are not as aggressive as they once were, and they are extremely conservative right now, and they do not move very fast. Unless you have the right nancial partner that has the dry powder to fund your acquisition and development growth, then there are a lot less players willing to fund A&D growth. Those remaining today are more conser-vative than 10 to 15 years ago.”As a result, Jayson approaches funding through robust partnerships. Selecting the correct t in a partner for ventures assists in taking some of the pressure off when it comes to nancial costs, but it also opens the door to increased opportunity. Each party brings a strength that outweighs the partner’s weakness. When the match is made, the venture possesses a more sig-nicant opportunity to weather costs and gain prots.Realizing the Political ComponentWhile the political landscape can impact the oil and gas industry, Jayson does not feel it inuences spending. Regulations directed at oil and gas carry a cost factor, but the areas affected are already included in companies’ calculations when operating the businesses.“I frankly do not believe the political en-vironment inuences much on spending,” says Jayson. “Even a company our size has its ESG policies, HSE policies, and has been focused on the environment for at least the past 15 years.”Jayson points to project development as a place where the political landscape impacts development. That inuence can originate from both the federal and state levels and can bruise the potential for future growth.“Some state regulatory bodies can severe-ly impact development plans on differ-ent projects in those areas,” says Jayson. “From a federal standpoint, the govern-ment can come in and reduce the per-mitting in areas like the Gulf of Mexico and in Alaska, but that is all outside of companies self-implementing ESG. There is a lot of window dressing. The industry has been implementing best practices for years, and we continue to improve.”Regardless of legislation implemented at the state and federal levels, Jayson remains focused on successfully managing U.S. Energy. From his vantage point, rules and regulations will continue to evolve. A more direct and head-on approach provides a better path to managing these issues and nding opportunities.“We have a company to run, and we have to adjust and implement rules as they are mandated,” says Jayson. “At the end of the day, we need to nd good projects, make good decisions, and hire great people.”Nick Vaccaro is a freelance writer and photographer. In addition to providing techni-cal writing services, he is an HSE consultant in the oil and gas industry with eight years of experience. Vaccaro also contributes to SHALE Oil and Gas Business Magazine, Louisiana Sportsman Magazine, and follows and photographs American Kennel Club eld and herding trials. He has a BA in photojournalism from Loyola University and resides in the New Orleans area. Vaccaro can be reached at 985-966-0957 or navaccaro@outlook.com. Jillian and Jordan Jayson at the 2023 Bowl for the Blue charity event, supporting local police ofcers and the Fort Worth community.

Oilman Magazine / July-August 2024 / OilmanMagazine.com20CARBON CAPTURE & SEQUESTRATION Key Investment For A Bridge To A Cleaner EnvironmentBy Jeff Whittle and Christé SpiersIn recent months, there has been a dawning realization that the barriers to a clean energy transition are more formidable than previously understood. Higher interest rates have made capital investment more difcult. Deciencies in the infrastructure required to deploy renewable resources are increasingly apparent. Geopolitical instability has brought the issue of energy security to the fore. Today, more than 760 million people, largely located in sub-Saharan Africa, lack access to energy and, ac-cording to the United Nations Depart-ment of Economic and Social Affairs (UN DESA), half of the estimated 28 percent growth in the world’s popula-tion between today and 2050 will be concentrated in nine countries, seven of which are classied as low or lower-mid-dle income by the World Bank. Security of affordable energy supply is critical for the economic advancement of all, not just those who have the economic means to pay a premium for green.The International Energy Agency (IEA), in its November 2023 report, The Oil and Gas Industry in Net Zero Transi-tions, states that with existing policies, global oil and gas demand will not peak until 2030, while conceding that even in a Paris Accord 1.5oC scenario, oil and gas is unlikely to disappear from our energy mix. Absent broad accep-tance of nuclear energy (which would take years to plan, build and deploy), a sudden breakthrough in nuclear fusion technology, or other unforeseen techno-logical advancements, hydrocarbons are not going away. In a world that still requires oil and gas, there are three ways to curb greenhouse gas (GHG) emissions: 1) reducing energy consumption, 2) switching to alternative clean energy resources, and 3) mitigating GHG emissions generated by fossil fuels. Much effort has and will continue to be placed on lowering con-sumption and developing new energy resources. But when it comes to reduc-ing GHG emissions, carbon capture and sequestration (CCS), however nascent, is one of the principal technologies avail-able and should play a key role in our efforts to move closer to Net Zero. Capturing carbon from a point source (i.e., industrial facility, power plant) is an ambitious endeavor. Facilities are expensive to build and to operate, and their construction often delayed and subject to cost-overruns. The process itself can consume a signicant amount of energy. Geography and geology are limiting factors. Carbon dioxide must be stored beneath impenetrable rock and if the point of capture is not near the required geology, it must be transported. While some CCS plants have exceeded 95 percent efciency, that efciency and, by association, cost varies across technologies and sources (Figure 2). Photo courtesy of dedmityay – 123RF.comFigure 1: Direct Air Versus Point Source Capture (Source: Technical Analysis of CO2 Capture Pathways & Technologies, Journal of Environmental Chemical Engineering)

Oilman Magazine / July-August 2024 / OilmanMagazine.com21CARBON CAPTURE & SEQUESTRATION Point source CCS methodologies include adsorption, membrane cap-ture, cryogenic separation, and algae systems. Each has its benets, in terms of cost-effectiveness and efciency, as well as disadvantages, in terms of being relatively cost-prohibitive, inefcient, energy intensive or environmentally-unfriendly (Figure 3). Direct air capture (DAC) extracts carbon from ambient air. DAC plants need not be specic to any location apart from proximity to a CO2 source and storage (or re-use) opportunity. At present, DAC processes are more inef-cient than point capture, are energy intensive, and are the most expensive means of CCS. However, multiple new technologies are in development and DAC is attracting investment from both private and strategic investors, while receiving government funding and policy support in the U.S., the EU, U.K., Canada and Japan.Figure 4 shows how CCS has been leveraged in the past and provides indications of future deployment. Prior to 2020, investment was focused on ethanol, natural gas processing, and industrial applications. Today, we are seeing evidence of the intention to employ CCS on a much larger scale, in the form of advanced development of transport and storage projects. Figure 4 suggests that broad application of CCS across industries is relatively recent. Today, CCS captures 0.1 percent of global emissions. While that statistic is unimpressive, this graphic illustrates we are in the early days of CCS develop-ment and deployment. Despite skepti. cism concerning viability, scalability and affordability of CCS, as well as the concern that carbon capture is simply a way of “kicking the can down the road” to Net Zero, investment and in-novation continues. In the U.S., the Infrastructure Invest-ment and Jobs Act of 2021 provided for $6.5 billion of carbon management funding. The Ination Reduction Act of 2022 provided $3.2 billion in ex-tended credits for CCS. Multiple energy companies, prompted by the need to decarbonize, and encouraged by public funding, have begun to implement ad-vanced CCS capabilities. The U.S. DOE recently awarded $1.2 billion to Oc-cidental Petroleum and Climeworks for DAC hubs to remove two million metric tons of CO2 per year. Signicant private investments continue. For example, Schlumberger (SLB) re-cently announced a $400 million invest-ment in Aker Carbon Capture which provides solutions for industrial, biofu-els, and hydrogen market segments. Ac-cording to Pitchbook, the median value of carbon capture-related non-strategic investment deals rose 142 percent from 2022 to 2023 and has risen 105 percent in 2024 to date. This investment interest is indicative of commitment to contin-ued innovation in CCS. However, the CCS market remains relatively nascent. Articial intelligence (AI) can help. In January, the University of Surrey published a study suggest-Figure 2: Estimated Range of Costs for Capturing a Metric Ton of CO2 in the US in 2019 (Source: Congressional Budget Ofce)Figure 3: Advantages and Limitations of CO2 Separation Technologies (Source: Science Direct. “Assessing Absorption-Based CO2 Capture: Research Progress and Techno-Economic Assessment Overview”)Continued on next page...

Oilman Magazine / July-August 2024 / OilmanMagazine.com22CARBON CAPTURE & SEQUESTRATION ing AI could improve carbon capture energy consumption by 36 percent. Researchers at Argonne National Laboratory have leveraged AI to de-sign, on an atomic level, metal-organic frameworks that selectively absorb carbon. Digital twinning is being used to optimize the CO2 storage process. Ultimately, the enhanced simulation capability of digital twins could opti-mize the CO2 capture in production or emission pathways, driving emis-sions lower. Academia has a signicant role to play in the further development of CCS. While government support has been a catalyst for investment in renewable energy and decarbonization technolo-gies, energy-focused initiatives similar to the bi-partisan passage and ongo-ing renewal of the Bayh Dole Act, which grants patent rights to inven-tors developing government-funded technologies, is an example of legisla-tion that puts taxpayer dollars to work driving innovation, entrepreneurial activity, and sustained economic growth. Other countries can follow this model as well. Strengthening an innovation economy should facilitate breakthroughs and increase our com-petitiveness against countries where government is the primary driver of innovation and economic growth. The energy trilemma refers to the challenge of creating an energy system that is economically, environmentally and socially balanced. This poses difculties for low and lower-middle economies such as India, Nigeria, the Congo, Pakistan, Ethiopia, Tanzania and Uganda from which the bulk of population growth will come over the next 25 years. For these countries, af-fordability is a prerequisite to survival. Even as we continue to develop renewable energy solutions, oil and gas will be a part of the solution for some time. Continued investment in CCS – from the private as well as the public sectors and academia – should be a strategic priority. However chal-lenged the CCS technologies are today, the promise of more efcient and cost-effective solutions can support a transition to greener energy while pro-viding an upward pathway and bridge to prosperity for all. Jeff Whittle is head of Womble Bond Dick-inson’s Global Energy and Natural Resources Industry Sector. He has nearly 30 years of legal experi-ence with clients in the energy and high-tech industries and serves as the Managing Partner of the rm’s Houston ofce.Christé Spiers is the Global Energy & Nat-ural Resources Sector Strategist at Womble Bond Dickinson. Figure 4: CCS Project Pipeline by Industry and Year of Operational Commencement (Source: Global CCS Institute)OILMAN PUZZLEAnswers

RENEWING WHAT’S POSSIBLESEPTEMBER 9-12, 2024 | ANAHEIM, CAREGISTER NOW |RE-PLUS.EVENTSRE+ 24 marks its 20th year as the largest and most comprehensive event in North America for the clean energy industry, and this year is going to be bigger than ever. Register today for discounted early bird rates through June 21.RE24+8.5x11.indd 1RE24+8.5x11.indd 1 5/23/24 12:26 PM5/23/24 12:26 PM

Oilman Magazine / July-August 2024 / OilmanMagazine.com24OILMAN CARTOON

4-7 November 2024Abu Dhabi, UAESecure your complementary visitor pass:www.adipec.com/attendRegister as a Delegatewww.adipec.com/registerJoin the world’s largest energy eventExhibition184,000+ 2,200+Attendees Exhibiting companies30Country pavilions54NOCs, IOCs, NECs & IECsConference16,500Delegates1,600+Speakers10Conferences350+SessionsUniting industries to acceleratethe energy transitionPartnersSupported byadipec.comADIPEC broughtto you byTechnical Conference organised byOfficialtravel partnerHost cityOfficialhotel partnerStrategic insights partnerKnowledge partnerSport & recreationpartnerOfficial media partnerVenue partnerCMYKSolid LogoMaster StackedGold sponsorsARAB DEVELOPMENT8385C 2756CPantoneMediumBlue CPlatinum sponsors

Oilman Magazine / July-August 2024 / OilmanMagazine.com26SURVEYRiding the Wave: Consumers Embrace Oil and Gas Environmental Impact, Stress Over Costs, and Grapple with DetailsBy Sapphire TechnologiesConsumer sentiment is a powerful force in driving climate action. Inspired by this thesis, Sapphire Technologies sponsored a survey of over 1,000 U.S. adults aged 18-plus weighted to be demographically representative of the U.S. population. The ndings shed light on opportuni-ties for oil and gas companies (O&G) to educate consumers on the efforts they are taking to mitigate climate change – and the impact those efforts will have on consumers, and their pocketbooks. Majority Positive Perception The majority of respondents surveyed believe oil and gas companies are at least somewhat environmentally friendly (59 percent), with 20 percent of respondents believing O&G companies are “very” or “extremely” environmentally friendly. Interestingly, Millennials and Gen Z respondents indexed slightly higher than older generations in indicating O&G companies are “very” or “extremely” environmentally friendly. These ndings are in line with a recent American Gas Association survey, which found that 63 percent of Americans agree natural gas is a clean source of energy and 70 percent believe the natural gas industry should play a role in reduc-ing overall emissions. Of course, oil and gas companies have made and continue to make substantial investments in reducing emissions, but consumers are not necessarily aware of these investments. Consumers Lack Information on Specic Environmental EffortsThe survey asked consumers how aware they are of specic sustainability efforts by oil and natural gas companies. Per-haps unsurprisingly, given the prevalence of the topic in news media, consum-ers are most familiar with oil and gas companies’ investment in renewable energy sources – 64 percent of survey respondents were at least “somewhat aware” of these efforts. However, the amount of investment made in a specic area of environmental sustainability did not necessarily correlate with consumer awareness of those efforts. Indeed, according to research rm Rys-tad Energy, cumulative global spending on carbon capture, storage, and utiliza-tion technologies could exceed $240 billion by 2030; yet, 51 percent of survey respondents were “not at all familiar” or “hardly familiar” with efforts O&G companies are making to expand carbon capture. Leading O&G companies are making substantial investments in scaling carbon capture. According to CNBC, Chevron plans to invest $10 billion in CCS and Exxon has pledged $20 billion to this emissions-reducing technology. In March of this year, SLB and TotalE-nergies both announced acquisitions of carbon capture companies to expand their portfolios. What Messages are Important for O&G Companies to Deliver to Consumers?It is important for O&G companies to educate consumers on the environmental impact of their supply chains and on mitigation efforts. However, to do so effectively, it is also important for O&G companies to understand consumer priorities when it comes to energy con-sumption. The survey asked respondents to rank in importance their top priorities as consumers of energy products. The majority of respondents (51 percent) ranked “minimize cost” as their top priority, “minimize emissions” was the second top-ranked priority (27 percent),

Oilman Magazine / July-August 2024 / OilmanMagazine.com27SURVEYfollowed closely by “minimize outages” (22 percent). With rising energy costs and both climate-related and geopolitical disrup-tions to energy security, it’s important to understand consumers care about minimizing emissions; however, they also care about affordability and energy security. As a February 2024 EY study bluntly stated, “Sixty-ve percent of energy consumers know how to start making sustainable energy choices, but 70 percent say they will not spend more time or money doing so.” While this may or may not be true, the opportunity exists for O&G companies to educate consum-ers on environmental efforts while also addressing concerns about the impact of those efforts on energy affordability and energy security. Let’s return to CCS efforts as an example. Carbon capture projects are underway throughout the oil and natural gas supply chains as a way of reducing emissions. However, these efforts can also yield rev-enue generating or cost-reducing oppor-tunities for O&G companies which help to offset the cost of investing in these de-carbonization technologies. Carbon cap-ture can help reduce venting emissions, and captured CO2 can be injected into oil reservoirs to increase recovery through enhanced oil recovery. Investments by O&G companies in carbon capture and storage technology can also generate new revenue streams through applications in hard to abate sectors. Indeed, according to CNBC, SLB projects carbon capture and storage will account for $10 billion in revenue within its overall energy portfolio by 2040, and Baker Hughes is targeting a market of six to seven times that amount for its new energy business. Upstream electrication is another area where environmental and economic sustainability go hand-in-hand. Drill-ing rigs and production infrastructure traditionally use diesel or natural gas turbines. According to SLB, 66 – 75 percent of energy produced is lost in this process. However, low-carbon elec-tricity can provide a solution that both reduces emissions and saves on energy costs for operators. For example, CNX is partnering with Sapphire Technologies to install Sap-phire’s FreeSpin® In-line Turboexpander (FIT) Generators at wellheads. These systems use advanced magnetic technolo-gies to convert kinetic energy from pres-sure reduction processes to create clean electricity. This clean electricity, generated from otherwise wasted energy in the upstream process, can be used to further reduce emissions by replacing alternative carbon-heavy energy sources. A protable business model translates to scalability for energy transition in-vestments. This not only means suc-cess against emissions reduction goals, Continued on next page...

Oilman Magazine / July-August 2024 / OilmanMagazine.com28but also it means these investments won’t impact reliability or affordability of downstream energy products for consumers. This is the tactical messag-ing that it would be prudent for O&G companies to deliver. How O&G Companies Can Reach ConsumersThe survey also sheds light on how consumers are getting their information on the environmental practices of oil and natural gas companies today. The majority of respondents (52 percent) turn to the news media to learn about the environmental practices of O&G companies. The news media was the most widely consumed source of infor-mation for every generation of respon-dent except Gen Z. For these younger consumers, social media was the most widely relied upon channel for informa-tion (45 percent). This insight provides both challenges and opportunities for oil and gas compa-nies. While the news media is still the most important information channel for consumers when it comes to educa-tion on the environmental practices of O&G companies, social media is of rising importance to younger consumers. Social media tends to support simpli-ed, short-form, and sometimes sensa-tionalized messaging which can pose a challenge when educating on a nuanced topic. However, the companies can look at alternative forms of communication (for example, video and animation) to distill complicated topics into social media-friendly formats. ConclusionsWhile consumers’ overall perception of O&G companies skews positive, O&G companies can benet from educating consumers around specic initiatives they are taking to reduce environmental impact. However, for consumers, the importance of environmental sustain-ability must also be weighed against the importance of affordable and reliable energy. O&G companies might nd that the best way to talk to consumers about environmental impact actually involves talking to consumers about the full picture – that is, one that takes into account affordability, energy security and environmental impact. For full survey results, visit our website.SURVEY

Energy Software | Oil and Gas Saas ERP SoftwareTHE MAGAZINE FOR LEADERS IN AMERICAN ENERGYMay / June 2022OilwomanMagazine.comAnn G. Fox President & CEO, Nine Energy ServiceEnergy Software | Oil and Gas Saas ERP SoftwareTHE MAGAZINE FOR LEADERS IN AMERICAN ENERGYMarch / April 2022OilwomanMagazine.comAleida Rios Senior Vice President Engineering, bpTHE MAGAZINE FOR LEADERS IN AMERICAN ENERGYJuly / August 2021OilmanMagazine.comEnergy Sector Cyberattacks: Threats Growing, Defenses Available p. 36How Cloud Software is Helping Energy Companies Move and Measure Hydrocarbons Backed by World Class Cyber Security p. 4Young Professionals in the Oil & Gas Industry: Interview with Adedayo Iroko p. 26Eliminating the Indecision of Exercising Stop Work Authority p. 10Mark A. Stansberry, Energy Advisor & Corporate Development StrategistTHE MAGAZINE FOR LEADERS IN AMERICAN ENERGYJuly / August 2022OilmanMagazine.comRandy Nichols, Founder & CEO, Cinco Energy Management GroupEnd-to-End SaaS ERP SolutionsTHE MAGAZINE FOR LEADERS IN AMERICAN ENERGYAugust 2021OilwomanMagazine.com NAPE + OTC Editionwith Mark StansberryTHE MAGAZINE FOR LEADERS IN AMERICAN ENERGYSeptember / October 2021OilmanMagazine.comForeign Countries Given the Green Light in Oil Production, U.S. Held Back p. 42ERP Innovation Imperative: Why Legacy Tech is Holding Back the Energy Back Ofce p. 4How an Energy Data Platform Fuels a Competitive Advantage p. 14The Digital Worksite Maximizes Operational Efciency, Ensures Safety During Turndowns and Shutdowns p. 12Gaurdie Banister, Jr., Former CEO, Aera Energy, and Corporate Board MemberTHE MAGAZINE FOR LEADERS IN AMERICAN ENERGYMarch / April 2021OilmanMagazine.comCliffe Killam, President & Partner, Killam Oil CompanyAssessing Downstream Cybersecurity Threats and Budgetary Concerns p. 40Four Ways Digital Unlocks Value for Oil and Gas in the New Normal p. 10The Fate of Flaring p. 32New Advances Lead to More Efcient Petrochemical Reneries p. 14THE MAGAZINE FOR LEADERS IN AMERICAN ENERGYJanuary / February 2022OilwomanMagazine.comIman Hill Executive Director, International Association of Oil and Gas Producers (IOPG)Energy Software | Oil and Gas Saas ERP SoftwareTHE MAGAZINE FOR LEADERS IN AMERICAN ENERGYNovember / December 2021OilmanMagazine.comThe American Shales: From Rich Rock, Uncon-ventional Ideas and Unwavering Determination to a Renewed World Energy Future p. 32Field Operations and Production Receive Big Boost in Information Systems Management p. 8Unify Well Delivery Processes Across Functions p. 24Interview: Brett Chell, CEO, Cold Bore Technology p. 12Jason Spiess, Journalist, Founder, The Crude LifeMental Health Special: Emerging from the Year That Was p. 24STEM: Thrill Seekers, Humanitarians, Inquisitive Types p. 14A Day in the Life of Robotics Entrepreneur, Dianna Liu p. 12Honorary Oilwoman, Chris Dao: What Power Means to Me p. 8THE MAGAZINE FOR LEADERS IN AMERICAN ENERGYMay / June 2021OilwomanMagazine.comDonna Fujimoto Cole, Founder and CEO Cole ChemicalTHE MAGAZINE FOR LEADERS IN AMERICAN ENERGYMay / June 2022OilmanMagazine.comOwners (left to right) Hank, Mark, Paul and Eric DanosEnergy Software | Oil and Gas Saas ERP SoftwarePaula Glover’s Holistic Approach to Leadership p. 42Dennis Kennedy, Founder, Energy Diversity & Inclusion Council p. 38Paula Gold-Williams: The Nation’s Only Black, Female CEO in Utilities p. 22Nuclear Myths Versus Reality p. 12THE MAGAZINE FOR LEADERS IN AMERICAN ENERGYJanuary / February 2021OilwomanMagazine.comPaula McCann HarrisFormer Global Director, Schlumberger Be the news or get the news.Advertising@USEnergyMedia.com • (800) 562-2340 Ex. 1SUBSCRIBE OR ADVERTISE TODAY!OilmanMagazine.com/subscribe OilwomanMagazine.com/subscribeTo subscribe, visit: To subscribe, visit:

Oilman Magazine / July-August 2024 / OilmanMagazine.com30PERSONAL TRANSITIONFrom Gold Medal Engineer To Digital Solutions DeveloperBy Prajakta Kulkarni Eleven years ago, I graduated as the gold medalist in petroleum engineering, a eld that was not popular among females at the time in India. My friends would mock me, [saying] that after college, I would end up working at a gas station. Ignor-ing all the teasing, my passion for rocks and my adventurous spirit gave me the condence to continue my journey in pe-troleum engineering. This backstory may seem unrelated, but every success story has its origins. After graduating, I began my journey on oil rigs. Despite winning the gold medal, I started from the basics, operating heavy machines, learning basics about forma-tions, designing perforations, and fractur-ing rocks to extract oil. The job took me to the most remote locations across India, revealing diverse cultures and workplace environments.During my time in the eld, I discovered my afnity for technology and people. I realized that I enjoyed not just the technological aspects of the industry, but also nding the best technology solutions for clients. This realization propelled me into technical sales, where I thrived on solving problems for my customers. My desire to explore different geographies further led me to Oman and then to the United Arab Emirates (UAE), where I engaged with multicultural clients and led teams for high-prole projects in chal-lenging environments. I delivered projects in extreme environments, pressures and temperatures. I successfully deployed and tested many of the newest and nest pieces of the technology during my time in the Middle East.My passion for discovering new territo-ries expanded my reach to more Middle Eastern countries. However, I noticed a pattern where sales strategies were falling short, leading to nancial losses. In an era dominated by data and statistics, I questioned why the oil and gas industry was not utilizing these resources effec-tively. This prompted me to explore ways to build models that could enhance sales strategies. This pursuit led me to my cur-rent role, where I am developing a data-driven product for pricing agreement management. This platform will not only optimize sales portfolios but also provide valuable insights into performance and areas for improvement.Navigating this role has been both re-warding and challenging. I’ve had to shift mindsets within my industry, a domain accustomed to traditional methods. The digital transformation I advocate has sparked concerns about job redundancy, but my interpersonal skills have helped me alleviate such fears. By showcasing the potential of technology to enhance productivity and create new opportuni-ties, I’ve managed to foster trust and drive positive change across all manage-ment levels.In addition to my primary role, I am also immersing myself in understanding data models and educating software engineers ALLY Energy 2023 GRIT Awards nalist. Photos courtesy of Prajakta Kulkarni.Prajakta Kulkarni in the Ruwais Diyab gas eld in the UAE (2020). Total rig in the background.

Oilman Magazine / July-August 2024 / OilmanMagazine.com31PERSONAL TRANSITIONCFO Services and Business Management ConsultingGet The Most From Your Energy BusinessOur Energy CFOs Help You Understand Your Company’s Financial Health and Drive Growth Save Time And Money • Transform Your Business • Understand Your Finances • Build Leader CondenceSchedule a CFO Consultation • www.theenergycfo.com • cfoinfo@theenergycfo.com • 210-802-8640 about the intricacies of the oil and gas sector. The scientic nature of this indus-try has shaped me into a skilled engineer, and I nd joy in mentoring young profes-sionals in my organization. I encourage them to look beyond their immediate roles and embrace continuous learning.I have recently pursued my executive edu-cation from Rice University in its global energy leadership program which opened doors to endless possibilities in the energy domain. During my time with a diverse cohort at the university, I learned the best change management strate-gies, AI usage and models, which can be implemented in energy industries and best cases of business strategies. I also in-teracted with several startup founders in the energy industry and understood their value proposition and uniqueness. I apply this knowledge in my role every day. This program truly gave me the opportunity to rediscover my passion and look forward to creating the best solutions.In essence, my journey from being a female, blue-collar engineer in a male-dominated eld to leading and develop-ing cutting-edge digital solutions for the oil and gas corporate industry has been marked by challenges and triumphs. Each day brings new insights and learnings that contribute to meaningful progress, which has conrmed my belief in the trans-formative power of small steps toward substantial achievements.Prajakta Kulkarni began her career as a petroleum engineer, working in India and throughout the Middle East. She is now the OFSE Com-mercial Digital Operations Leader (Regions: NAM-L and Offshore, LATAM, APAC, MENATI, KSA, SSA and ENSC) for Baker Hughes.Kulkarni holds a Bachelor of En-gineering – Petroleum Engineer-ing – Gold Medalist (University 1st Rank Holder) from the Maharashtra Institute of Technology in Pune, In-dia, and graduated from the Global Energy Leadership Program at Rice University in Houston, Texas.Kulkarni was an ALLY Energy 2023 GRIT Awards nalist for a profes-sional making a change in the energy industry. Baker Hughes workshop.

Oilman Magazine / July-August 2024 / OilmanMagazine.com32WIND ENERGYNew York’s South Fork Wind Project Marks Major MilestoneBy Katie NavarraThe South Fork Wind Project marks a signicant milestone in New York State’s journey toward renewable energy. The project was the rst utility-scale offshore wind farm to begin operation in the United States when the rst two of 12 turbines began generating power on December 6, 2023.The 12-turbine project is located ap-proximately 35 miles east of Montauk Point on Long Island and was fully functional in mid-March 2024. The South Fork Wind project will generate 130 megawatts (MW), which is enough to power about 70,000 homes annually. Its successful completion is the rst step toward the state’s Climate Leader-ship and Community Protection Act requirements. The Act is designed for the state to achieve 70 percent renew-able energy by 2030, which includes the installation of nine gigawatts of off-shore wind by 2035. “Clean, renewable power owing from the South Fork Wind project is an important part of our overall mission to create a clean-energy economy in New York State,” said Public Service Com-mission Chair Rory M. Christian in a March 2024 press release.South Fork Wind was the rst com-mercial-scale offshore wind project completed as part of the Biden adminis-tration’s offshore wind energy initiative. Eight commercial-scale offshore wind power projects totaling over 10 GW have been approved through the initia-tive, the rst steps in reaching the goal of 30 GW by 2030. In April 2024, Secretary of the Interior Deb Haaland announced in a press release “a new ve-year offshore wind leasing schedule, including up to 12 po-tential offshore wind energy lease sales through 2028.”The South Fork Wind project, a partner-ship by Ørsted and Eversource, relied on Long Island companies to install the underground duct bank, onshore substa-tion, and onshore cables, manufacture the concrete buttresses, and fabricate steel for portions of the project foun-dations, according to Ørsted’s website. Manufacturing and assembly of multiple other project components also occurred domestically in Texas, South Carolina, Rhode Island and Connecticut.“From the rst steel in the water to the nal turbine, our hard-working off-shore wind construction team has put South Fork Wind on the path to making American energy history. We’re incred-ibly proud of our dedicated project, permit and construction teams, and all those who have made this milestone possible,” wrote Ørsted Group EVP and CEO Americas David Hardy in a statement. Additional Commercial Scale Offshore Wind on the Horizon Flipping the switch on the South Wind Fork project coincided with an an-nouncement by New York Governor Kathy Hochul that two more offshore wind projects have been awarded and are known as Empire Wind I and Sun-rise Wind. According to the Governor’s ofce, the sites will collectively generate more than 1,730 Megawatts of energy and $2 billion in near-term economic develop-ment investments. Equinor is develop-ing Empire Wind 1, an 810-megawatt project located 15 miles off the Long Island shore across 80,000 acres in ocean waters ranging from 75 to 135 feet deep.Construction started with a ground-breaking on June 10, 2024, for the South Brooklyn Marine Terminal, which will serve as the hub for offshore wind projects along the East Coast. The project has received approval to connect to New York’s electric grid, and comple-tion is expected by 2026.Sunrise Wind, a 924-megawatt project developed in partnership by the Ørsted Group and Eversource, which has since sold its stake to the Ørsted Group, is es-timated to power nearly 600,000 homes in New York once completed.NY Gov. Kathy Hochul at the Sunrise Wind groundbreaking on July 16, 2024. Photo courtesy of Ørsted.